When a business has a high inventory turnover ratio, they become agile and respond effectively to constantly changing customer needs. Inventory turnover is the definitive key performance indicator (KPI) for the retail sector as it helps businesses plan ahead in order to increase profitability. Achieving growth in the retail industry requires a decent number of sales and profitability. Make your business more profitableĪ well-designed inventory management system enables companies to grow in the right direction by optimizing stock orders, warehousing, and distribution. That being said, technological advancements have contributed to the development of omnichannel solutions that provide retailers with the ability to get inventory forecasts while eliminating the risks of human error.

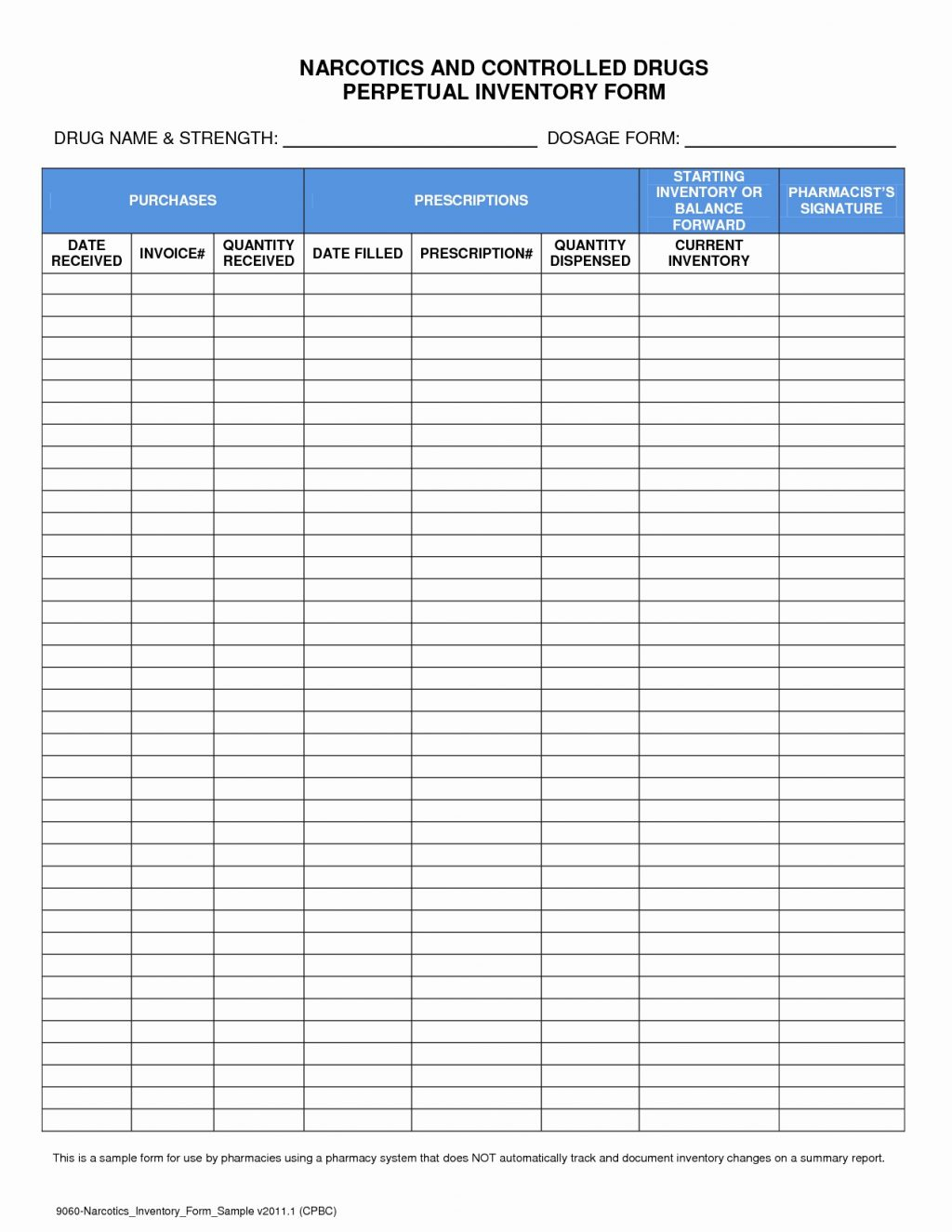

#Industry inventory turnover ratio manual#

Manual methods of inventory turnover management take up a lot of time and expertise, which is simply not feasible for today’s modern business environment. Businesses that do not have effective inventory management systems tend to experience stockouts and delays in order deliveries. Keeping track of inventory is important to ensure timely order fulfillment, which in turn leads to higher customer satisfaction. Inventory Turnover from a Business Perspective For instance, keeping an eye on inventory helps get a hold of the next pricing strategy, purchasing, manufacturing, and marketing. However, taking into account the areas affected by a weak inventory management system, it is important for companies to assess where they stand. On the surface, it seems that inventory management is just one of the aspects a business has to consider. Knowing how often they need to re-stock, or which items sell faster, allows them to take better decisions for the future. Modern businesses realize the importance of supply chain visibility and developing an efficient inventory turnover strategy.

#Industry inventory turnover ratio how to#

It enables them to efficiently manage assets, as well as help, decide when and how to invest in new items. For omnichannel retailers, inventory turnover is a benchmark that measures how quickly a company sells its products. The financial unit known as the inventory turnover ratio depicts how many times a company sells its entire inventory in a given period.

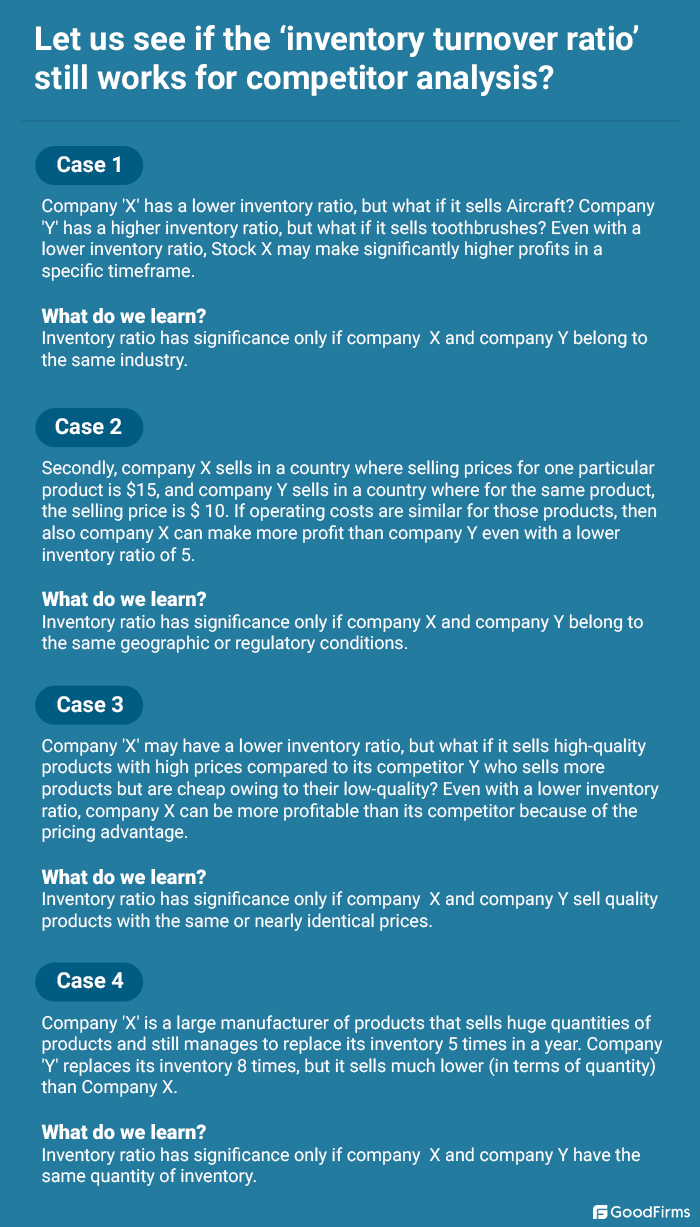

We can conduct the same exercise for the other years for both companies, and we will build the following graph.What is Inventory Turnover? Inventory turnover is defined as the amount of time a particular item spends in a company’s inventory, from its purchase till when it is sold. On the other hand, inventory days show the investor how many days it took to sell the average amount of its inventory.įor example, let's say Company A has an inventory turnover ratio of 14 \small \rm Inventory days = 54.1 Inventory turnover shows how many times the inventory, on an average basis, was sold and registered as such during the analyzed period. It is worth remembering that if the company sells more inventory through the period, the bigger the value declared as the cost of goods sold. The more efficient and the faster this happens, the more cash a company will receive, making it more robust against any face-off with the market. In order not to break this chain (also known as Cash conversion cycle), inventories have to turnover. Once the company is running, cash for sustaining operations is obtained from the products sold (cash inflow) and from short-term liabilities from financial institutions or suppliers ( cash outflow). At the very beginning, it has to be financed by lenders and investors.

Note that depending on your accounting method, COGS could be higher or lower. Once we sell the finished product, the company's costs for producing the goods have to be recorded on the income statement under the name of cost of goods sold or COGS as it's usually referred to. It has a high degree of liquidity, meaning that we expect it to be converted into cash in a short period of time (less than one year). On the Accounting side, we consider inventory as a current asset recorded on the balance sheet. Some companies might buy manufactured products from different suppliers and sell them to their clients, like clothes retailers meanwhile, other companies could buy pig iron and coke to start steel production.īoth of them will record such items as inventory, so the possibilities are limitless however, because it is part of the business's core, defining methods for inventory control becomes essential. Therefore, it includes all the material process transformation. As per its definition, inventory is a term that refers to raw materials for production, products under the manufacturing process, and finished goods ready for selling.

0 kommentar(er)

0 kommentar(er)